It’s the third decade of the new millennium and contact center management is under duress. A different kind of duress, actually, at least for banks. In addition to their responsibilities as a means to control and cut costs — that is, deflecting assisted contacts, reducing handle time, and so on — contact center management is now expected to drive business outcomes that contribute to growth.

Today, heads of customer service and digital customer experience, even CIOs, are asking new questions:

- How can we leverage the contact center and self-service to meet a customer’s unmet needs?

- Could we add value and increase customer satisfaction by recommending products?

- How can customer service representatives (CSRs) increase long term customer loyalty?

The race to turn contact centers into profit centers is on.

Relevant Reading: 3 Research-based Roadblocks (and Resolutions) for FinServ CX

Can the Contact Center Contribute to Business Growth? Yes, With One Caveat

It’s not a small ask for a business unit that’s not traditionally viewed as a profit center. Nevertheless, it’s what growth-oriented FSIs tend to do. A Trends in Financial Services report from Salesforce found that growth-oriented FSIs are 15% more likely to expand support for new channels and 22% more likely to invest in omnichannel service.

That report goes on to explore some of the services-related activities that can lead to said growth. Personalized communications and product offers, for example. Autonomous finance use cases, such as portfolio optimization, automated claims processing, and our personal favorite, proactive customer service.

Can self-service channels in banking add value in these efforts? Absolutely. But it requires a commitment to deepening the relationship by better understanding and applying the customer behavior signals sent through a digital channel.

This presents a distinct challenge for contact centers still in cost-center mode.

The Problem: Too Many Self-Service Channels Strung Together Piecemeal

There’s a reason that creating a unified customer experience is the number one trend according to the 2022 FICO Trends Report. A unified, omnichannel experience is no walk in the park.

For one, there’s an increasing number of channels for contact center management to attend to, including:

- Phone

- Live Chat

- Chatbots

- FAQ

- Social media

- Messaging

- Branch

- SMS/Text

As a result, the questions, calls, and inquiries are endless.

This creates many opportunities to drop the ball. In this environment, a bad experience can come in many forms. The most common (and costly) is the customer who wants to self-serve for a low-touch issue, but can’t find the answer. So they call in for help … over, and over, and over again. You’ll know this is happening at scale when the contact center’s first tier is bombarded with repeat issues every day-and agents are burning out and turning over as a result.

But there are more nuanced examples, too. Imagine you’re a banking customer that comes to the support site to get information about lowering your interest rates. Turns out, you’re qualified for a credit card product that would lower your rate and improve your financial well-being.

The question is, will your digital experience be tailored in a way that enables you to find that product?

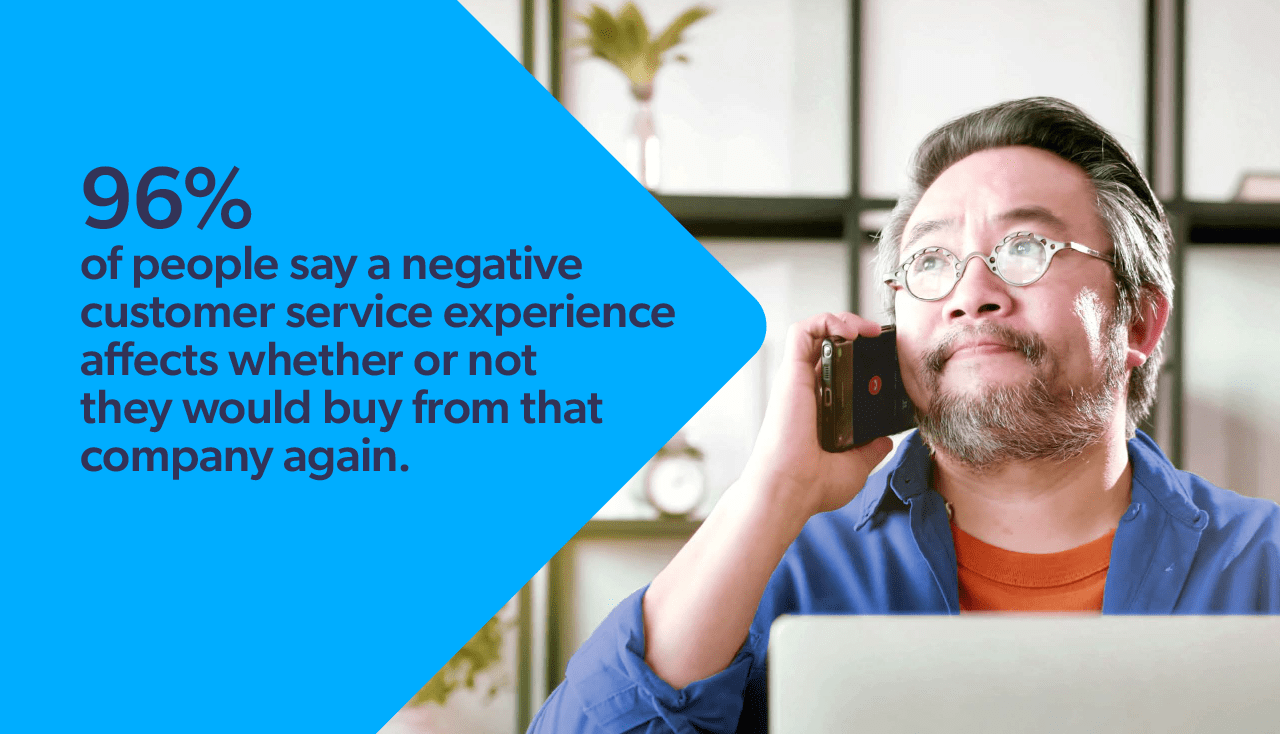

What’s intriguing about both scenarios is what happens when customers don’t get the digital self service experience they expect. As research from our own Service Relevance Report 2022 indicates, the cost can be quite dire: 96% of people say a negative customer service experience affects whether or not they would buy from that company again.

Not exactly a boon to customer retention, is it?

Unfortunately, that’s just what the contact center sees. Our report also found that 46% of customers “rarely or never” complain about bad experiences, up 2% from the previous year. They just move on, meaning all of those bad experiences might be quietly adding up to hidden costs that hurt the bottom line.

The Good News: The Answer Lies In Unlocking Something You Already Have

I recently spoke with a client who solved a new-hire turnover problem in an interesting way. She used an AI-powered application to automatically record her reps’ conversations, analyze those calls for best practices from top performers, then disseminate the top examples for new hires to learn and replicate.

Brilliant, right? She knew the answer to her turnover issue was buried in the hundreds of interactions already taking place everyday. She just needed a way to extract and apply those insights, something she couldn’t feasibly do through manual processes.

An AI-powered relevance platform applies this same concept to self-serve channels. Because your company already has the answers that customers need; you just don’t have the means to unlock and leverage that knowledge across your many service channels. Especially not at scale.

Using a combination of knowledge management and AI-powered search that leverages behavioral data, relevance platforms provide 1:1 personalization across all channels. That means customers can self-serve answers to the questions you’ve heard hundreds of times before — wherever and whenever they want.

The Value-Add: How Relevance Platforms Create Value in Customer Service

An AI-powered relevance platform can lead you to value where you didn’t think to look before. For one thing, the platform listens to and analyzes what customers are telling you each time they perform a search, call in, or otherwise interact. This data can reveal novel questions that suggest the need for a product improvement or new feature.

Maybe there’s a bottleneck along the customer journey you never saw before.

Beyond finding product improvements and process in efficiencies, the new value streams come in the form of optimized customer loyalty. That is, reliably predicting points in the customer journey where a value-add — the personalized “right” answer or financial wellbeing recommendation, for example — will keep a customer or enable share of wallet growth.

I often share the example of a consumer goods manufacturer who turned their customer self service content into a revenue driver. The manufacturer’s relevance platform told them that one of their most popular knowledge base articles, “When is it time to replace my refrigerator’s water filter,” was often the last article people saw before booking an expensive field call.

So they embedded a call-to-action in that article that allows the customer to run a quick check on their refrigerator model and order a replacement filter on the spot. The outcomes? Not only can they track purchase revenue generated by this article; but they can reliably quantity the cost of prevented field calls, too.

In banking, we see myriad use cases of the same concept. Some bankswill surface content recommendations to CSRs based on their customer’s search activity — recommendations that would solve a problem or add value to the journey first, before profiting the company. The CSR can then hand that off to the right person or, in some cases, handle the transaction right then and there.

Bottom Line: Create Value With An Abundance of Relevance

There’s a lot of ways to transform self serve channels into profitable outcomes. None of it is possible if an bank doesn’t have a platform capable of effortlessly connecting self service channels. In addition, the climb will be steep with the wrong attitude: this isn’t about cutting off communication with the customer. The goal isn’t to contain 100% of contacts, or to upsell every single customer who reaches out for help.

It’s about creating value along whichever journey to resolution the customer prefers. You can’t force everyone down a path of self service; some customer questions still include human interaction. Our research shows that more than 52% of Baby Boomers will drop a brand if they can’t speak to a person. Then again, younger consumers prefer DIY: 40% of Generation Z say they will abandon a brand if they can’t resolve an issue on their own.

The goal isn’t to contain100% of contacts, or to upsell every single customer who reaches out for help — it’s about creating value

The only scalable means for accounting for this variety in preference is to create an abundance of relevance. AI-powered search stitches together content silos and surfaces relevant results across self-service channels in banking. The idea is to make each of those journeys as good and personalized as can be.

From there, it’s far easier to unearth new opportunities to transform the contact center from a cost saver to a profit generator. And we have a few ideas to get you started, from the mind of customer service expert and author of Strategic Customer Service, John Goodman.

Dig Deeper…

In the 2022 FICO trends report cited above, the authors list The 4 Greatest Barriers to AI Adoption Today. They are:

- Building a team with the right skills (65%)

- Dealing with data and algorithmic ethics (65%)

- Integrating new technologies with legacy systems (61%)

- Meeting regulatory or compliance requirements (59%)

If those sound familiar, I certainly understand. But guess what FICO’s number one step for integrating this kind of intelligence across a financial service enterprise? Adopting a “unified, scalable digital decisioning platform,” aka Coveo.

Of course, there’s more that goes into integrating a self service relevance platform than flipping a switch — especially in the banking industry. The good news is that Coveo can help (and has the receipts to prove it).