The 2024 holiday shopping season is in full swing, with Black Friday and Cyber Monday once again proving to be major highlights. Coveo customers drove impressive results, transacting hundreds of millions of dollars in online revenue over four days, with Cyber Monday surpassing Black Friday in online sales. These numbers underscore the transformative impact of AI-driven experiences in boosting holiday performance.

As 197 million shoppers turned out over this period, the focus now shifts to value-driven purchases, as consumers navigate inflation by prioritizing thoughtful spending for the remainder of the season. To prioritize gifts, people are cutting back on non-essentials like dining out, clothes, events/outings, and travel.

In our 2024 Holiday Shopper Report, 76% of consumers surveyed were primed to spend at least as much as – or more – on gifts as they did last year. And although 85% of respondents expressed at least one holiday-shopping-related concern such as cost or finding the right gift, the same percentage of consumers said they often make impulse purchases when shopping online.

Top Gift Categories Shaping Holiday Sales

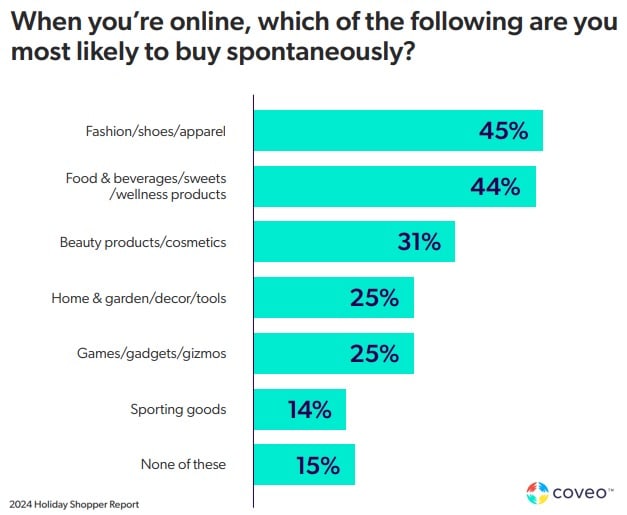

Top impulse purchase items fell in the categories of fashion, food, wellness, and beauty, as the following chart illustrates.

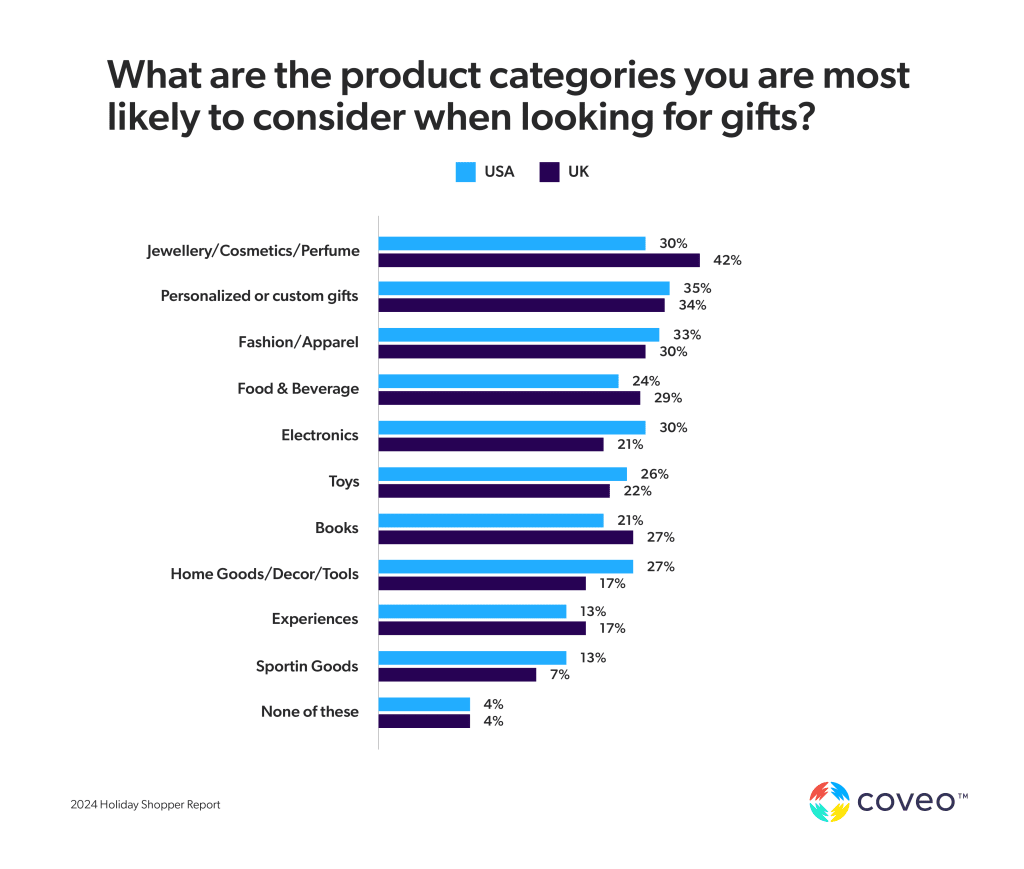

Our survey highlighted clear preferences in gift categories, with some regional variations. Overall, the top categories included:

- Jewelry, cosmetics, and perfume (36%)

- Personalized or custom gifts (35%)

- Fashion and apparel (32%)

In the UK, jewelry, cosmetics, and perfume were the most popular at 42%, followed by personalized/custom gifts (34%) and fashion/apparel (30%). In the US, personalized/custom gifts topped the list at 35%, followed by fashion/apparel (33%) and jewelry, cosmetics, and perfume (30%).

Price Sensitivity and the Importance of Quality

Cost was the top reason shoppers cited for deciding whether to buy from a retailer, with 75% of respondents listing cost or budget concerns. This was followed closely by product quality at 70%. Customer service and experience ranked third, with 54% of respondents saying that positive or negative customer service and past experiences influenced their decision to buy from a retailer or brand.

When asked about their biggest concerns for the holiday shopping season, including Black Friday, budget and cost once again emerged as the top worry, with 29% of respondents highlighting this issue. After that, 14% of shoppers expressed concerns about finding the right gift. On-time delivery rounded out the top three concerns, with 11% of respondents noting this as their primary worry.

The Role of Virtual Assistants in Holiday Shopping

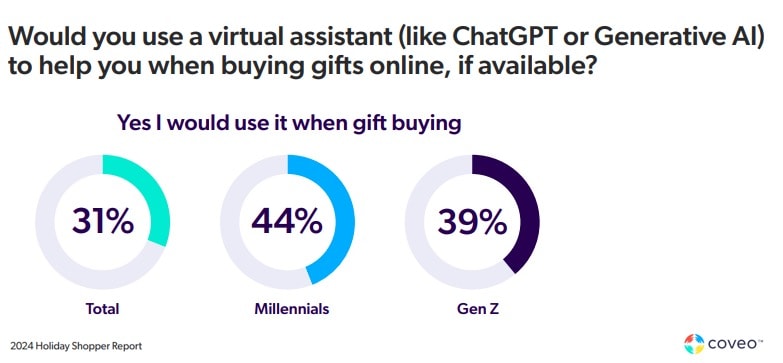

We asked respondents how likely they were to use a virtual assistant for holiday shopping help, and while adoption is still emerging, there’s clear potential for growth. Although 69% of respondents indicated they hadn’t yet embraced these tools, this signals a significant opportunity to demonstrate the benefits of AI-powered assistance.

Here’s a closer look at the results:

UK shoppers were slightly more resistant to using virtual assistants for holiday shopping compared to US shoppers (72% versus 65%, respectively). With the exception of Gen Z, resistance to using these tools increased with age. Millennials were the most willing, with 44% open to using virtual assistants, compared to other age groups. Respondents aged 60 and over largely said “no” to using tools like ChatGPT for their digital holiday shopping. Here’s the age breakdown of those who responded “no”:

- Millennials: 56%

- Gen Z: 61%

- Gen X: 68%

- Baby Boomers: 84%

- Silent Generation: 85%

Lower-income households also showed greater resistance to AI-powered tools for gift selection. Here’s the breakdown of those who said “no” by income bracket:

- Under $25k: 75%

- $25k – $49k: 72%

- $50k – $100k: 63%

- Over $100k: 53%

How Shoppers Find Special Offers

We asked respondents how they currently find special offers and learned that going straight to the brand or retailer – either online or in physical stores – was the most popular method. Nearly half (48%) of respondents said they do this (51% UK versus 44% US).

Email was the second most popular method (36%), followed by social media (35%), and an online search engine like Google (32%). About a fifth of respondents listed traditional (offline) methods like TV, word of mouth, and print mailing/coupons as sources for special offers. Interestingly, 61% of respondents say that specific gift search categories like “gift for dads” or “gifts under $50” are helpful when shopping online – so incorporating categories like this on your website or in stores can help those customers looking for offers and inspiration.

6 Key AI-Focused Takeaways for Digital Shopping in 2025

Insights from our 2024 Holiday Shopper Report highlight essential learnings for digital shopping in the coming year. Here are six key trends to keep in mind as you plan for the next holiday season and beyond:

#1. AI Will Help Increase Average Order Size

Ninety percent of survey respondents said they could be persuaded to add items to an existing online order. When asked what would most compel them, the top reason was “meeting the minimum spend to get free shipping,” followed by relevant special offers and personalized product recommendations. AI plays a crucial role in enabling these persuasive tactics, allowing retailers to provide timely, personalized recommendations based on real-time data and customer behavior.

#2. Intelligent Search Will Fuel Spontaneous Purchases

As mentioned, over 80% of respondents reported making spontaneous purchases online. AI tools like intelligent search are set to drive even more impulse buys by connecting shoppers with relevant items based on user data, in-session behavior, and search context. AI-powered search not only delivers personalized results but also suggests complementary items, highlights limited-time offers, and enhances search with autocomplete suggestions. This helps shoppers discover products they’ll love—even when their search query doesn’t exactly match the product description.

#3. Generative AI Will Support Online Gift Buying

Generative AI, integrated into assistants like ChatGPT and Google Assistant, is set to transform online gift shopping. This shift is likely to go beyond holiday gift-buying, making AI-assisted shopping a routine choice for consumers. Nearly a third of our survey respondents are already open to using AI assistants for gift buying, and this number is expected to rise as consumers grow more comfortable and experience successful outcomes with these tools.

Asking an AI for advice on a Father’s Day tie or the top PS5 games for a 14-year-old—and receiving a human-like, helpful response—is a compelling experience. This trend is especially popular among younger generations and higher-income households, who show the greatest openness to AI-assisted shopping.

#4 AI Will Inform the Entire Omnichannel Shopping Journey

In 2025, we predict that AI will personalize (and thus revolutionize) the entire shopping journey. Advanced AI algorithms allow sellers to individualize messaging and experiences at the per-shopper level. While personalized product recommendations are already the norm, entire experiences like custom ‘shops within shops’ will be possible, thanks to improved ML algorithms.

AI-powered generative experiences will be at the forefront of this transformation. As GenAI becomes more sophisticated, it will deliver hyper-personalized shopping journeys that adapt in real-time to individual preferences and needs. This technology will offer tailored advice and recommendations and assist with specialized tasks — such as meal planning for online grocery orders.

#5 Online Grocery Shopping Will Play a Bigger Role in 2024

Grocery shopping is making a significant move into the digital space. Our survey revealed that 55% of consumers plan to grocery shop online or use delivery apps for holiday meals and parties. More than half of the consumers we surveyed said they plan to shop online for groceries during the holiday season, with 20% reporting an increase in their typical online grocery habits. This trend is particularly pronounced among Millennials and Gen Z, nearly 70% of whom plan to take advantage of online grocery services. For grocery retailers, this is a clear signal that digital convenience is no longer just nice-to-have — it’s an expectation.

#6 Mobile Shopping Will Take Center Stage

80% respondents to our survey said they discovered special offers through digital channels, with mobile playing a significant role. As we look ahead to the coming year, consumers will continue to embrace mobile shopping as part of a connected shopping experience. That requires seamless integration between mobile apps, websites, and in-store experiences. Consumers expect to start their shopping journey on one device and complete it on another – or even in-store – without any hiccups. Think omnichannel for 2025 and you’ll be golden.

Get More Insights: Download the Full Report

The holidays may be in full swing, but it’s never too early to prepare for what’s next. Download the 2024 Holiday Shopper Report and unwrap the insights that will set you up for success in 2025—and beyond.