Coveo’s fourth annual shopper survey shows the youngest adults are the least satisfied with retail websites but hope GenAI can help them improve.

In the U.S. today, Generation Z consumers hold $360 million spending power, even though only half of the generation (born between 1997 and 2012) has reached adulthood. By 2030, this growing consumer force will amass almost $13 trillion in spending power worldwide.

Gen Z adults, aged between 18 and 26 years old, bear the imprint of the Covid-19 pandemic because stay-at-home rules and virtual schooling upended their lives during the high school and/or college years when young people typically start testing their independence — which might have included a trip to a shopping mall with friends. Instead, Gen Z was forced to become even more dependent on the digital devices and social media apps they grew up with.

The pandemic taught them that the world was unpredictable, making them more careful with their finances and flexible in how they think about making a living.

According to a GWI report, “The new age of Gen Z,” this cohort is more likely than average to say they’re price-conscious and that being financially secure is important to them. “When times get tough, they’ll be the first to cut back on unnecessary spending,” the report says.

On the other hand, Gen Zers have embraced the entrepreneurial trend of gig work. Even if they are employed full-time, they still might make money on the side as a social media influencer, an Uber driver, or a freelancer. This is a source of discretionary income retailers can learn to tap into.

Against the backdrop of Gen Zers’ increasing incomes and influence, though, they have been the least satisfied of all adult generations when it comes to ecommerce.

Retailer Websites Continue to Disappoint Gen Z

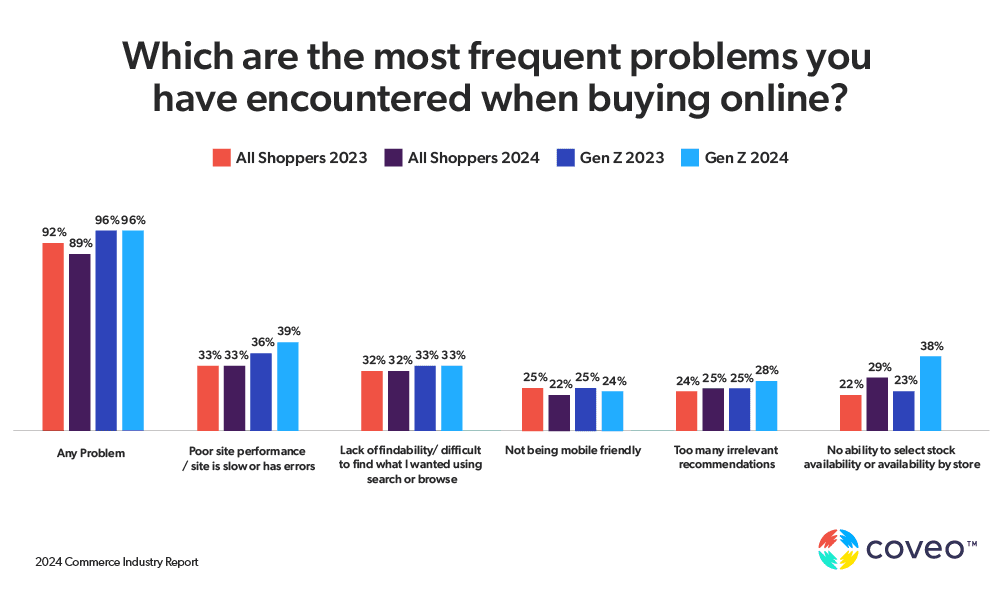

In Coveo’s fourth annual commerce industry report, based on a survey of 2,000 U.S. and 2,000 U.K. adults, 89% of shoppers said they encountered one or more problems while shopping online, but 96% of Gen Z respondents said something went wrong.

Poor site performance, websites that are slow to load or have errors, is Gen Zers’ top complaint, and more young shoppers reported the problem in 2024, at 39%, than in 2023, when it was 36%. Whether retailers are having more problems providing basic website functionality or Gen Zers have less tolerance than a year ago, the fact that almost one in four Gen Zers are complaining about website performance should be a clarion call for action among retailers.

The inability to select stock availability for products online or in retail stores ranks as the second-most-common problem for Gen Zers in 2024, at 38%, compared to 29% of shoppers overall.

Retailers are missing opportunities when they keep in-stock positions out of view on their websites, according to a study conducted by a Boston College professor in partnership with Instacart.

When retail site visitors were informed that stock levels were low on certain items, shoppers were 25% less likely to purchase them—but that was a good thing for retailers because the shoppers self-selected products that were more reliably in-stock, resulting in a 5.3 percent increase in revenue per customer over time, the study found.

Moreover, as Coveo’s commerce study found last year, 48% of all shoppers, including Gen Zers, respond to urgency messages, and knowing that a product is about to sell out could prompt a shopper to make a purchase more quickly.

Ranking third among Gen Z complaints is “lack of findability”—or shoppers having difficulty finding what they want using search or browse. Slightly more Gen Zers, 33%, reported search issues in 2024 than shoppers overall, at 32%. These numbers haven’t changed year-over-year (YOY), but it’s bad news that retailers have not been able to improve the critical search function on their websites.

According to Gen Z, retailers are also failing to provide relevant and personalized recommendations, a companion function and enhancement to ecommerce search, with 28% reporting the problem in 2024, up from 25% in 2023.

GenAI Provides Hope for Frustrated Gen Zers

A study of U.S. consumers by PYMNTS Intelligence found that interest in AI-enabled shopping and banking services is growing among consumers, especially among Gen Z. While 40% of consumers expressed this interest in AI-enabled shopping, approximately 60% of Gen Zers were attracted to it.

When Coveo asked Gen Z consumers how they expected their online shopping experiences to evolve with conversational experiences like ChatGPT/generative answering (GenAI), virtual shopping assistants appealed to the majority (58%) of Gen Zers, as compared to 49% of total respondents. Gen Zers anticipated that virtual assistants could help them with troubleshooting (37%) or guide them on product selection (35%).

In addition, 42% of Gen Zs think GenAI could help educate them on products and their attributes before they start shopping for a specific product. Only 37% of shoppers overall gave that answer.

While more than one-quarter (28%) of survey respondents said they did not see the value of GenAI or expect it to evolve their shopping experiences, only 18% of Gen Zers gave that response. In other words, more than 80% of young adults expect GenAI to improve ecommerce.

Retailers looking to attract and retain this digital-savvy generation should know that artificial intelligence— particularly machine learning and deep learning — are essential. These technologies can help retailers understand shopper intent (even if they’re anonymous), personalize at scale, and stitch customer journeys together across channels.

In ecommerce, retailers can begin answering high-level shopping questions rather than depending on the limited input of keywords. For example, instead of typing “hiking equipment” to generate dozens of products, a shopper types the query, “I’m going hiking in Yosemite tomorrow. What should I pack?” AI recommendations would then include products suited to summer or winter weather and the rugged terrain, as well as to articles and reviews that specifically mention Yosemite.

To relevantly (and consistently) answer questions like these, though, retailers need to bring product data and educational content together to deploy unified search, which ensures that the responses customers receive are technically correct, accurate, and with source links for fact-checking.More than other generations, Gen Z is aware of the possibility that GenAI can “hallucinate” or produce output that’s inaccurate, false, or misleading. When Coveo asked shoppers which negative self-service experiences are most likely to impact their perception of a brand, 24% of Gen Z respondents chose “experiencing a hallucination,” as compared to 21% of shoppers overall.

Gen Zs Branch Out in Finding What They Want

Using social media is innate for Generation Z, and it is increasingly becoming a method they use for search. eMarketer surveyed more than 1,000 U.S. consumers aged 15 to 26 and found that 51% use social media when they are “actively looking for more information about brands, products, or services,” but only 45% use traditional search engines.

Coveo found that Gen Zers are much less likely than shoppers in general to use web search engines like Google or Bing to find products before buying them from a retail website. While 59% of respondents use a search engine before buying on a retail site, only 43% of Gen Z respondents do.

While Snapchat is the social app Gen Zers use most, with 51% accessing it at least once a month, TikTok is close behind at 45%. According to GWI, “outside China and India, Gen Zs’ use of TikTok to follow/find information about products and brands has grown 104% since Q4 2020.”

Social commerce—where a shopper finds a product on social media and goes on to purchase it within the app—is catching on slowly. While 39% of Coveo survey respondents “often” or “always” find products that catch their interest on social media, only 14% purchase them within the app. Among Gen Z respondents, though, 37% both research and buy products on social media.

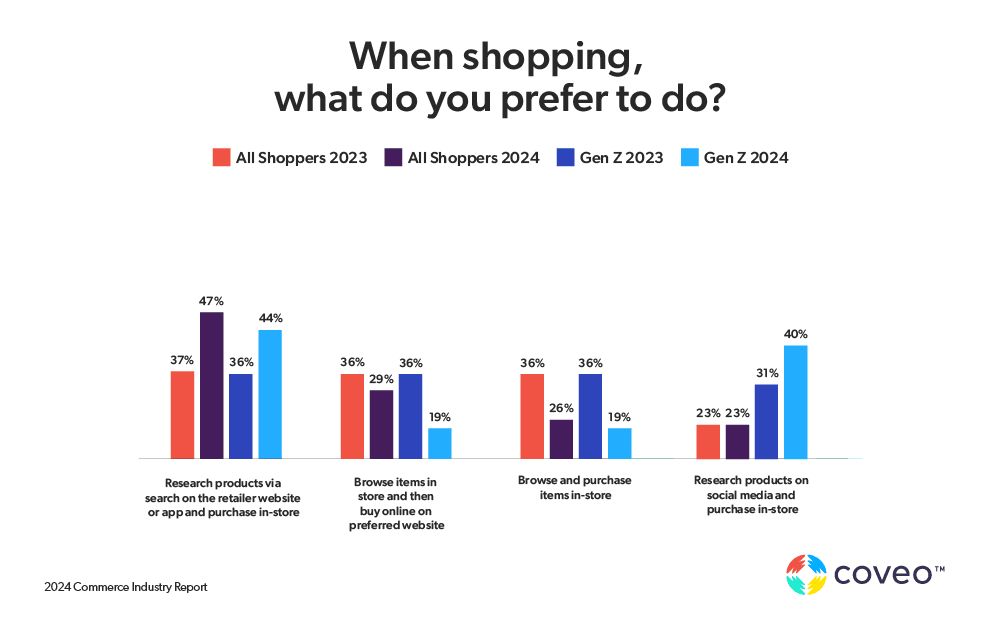

Coveo found that while 40% of Gen Zers research products on social media before purchasing them in a store, only 23% of shoppers overall do so. And social media has become even more influential over the past year, rising to 40% from 31% of Gen Zs in 2023.

At 44%, Gen Zers are less likely to research products via search on the retailer website or app before purchasing them in a store than shoppers overall, at 47%, but the percentage of Gen Zers using ecommerce search before buying in a retail outlet rose significantly, from 36% to 44% YOY. That means that a retailer’s ecommerce site is becoming even more influential to Gen Zers who will ultimately make an in-store purchase.

Gen Z and the Privacy Personalization Paradox

Shoppers surveyed by Coveo over the years have voiced concerns about how online retailers are using their personal data, but they have also been willing to share data with brands they trust when they get something in return, such as discounts or personalization.

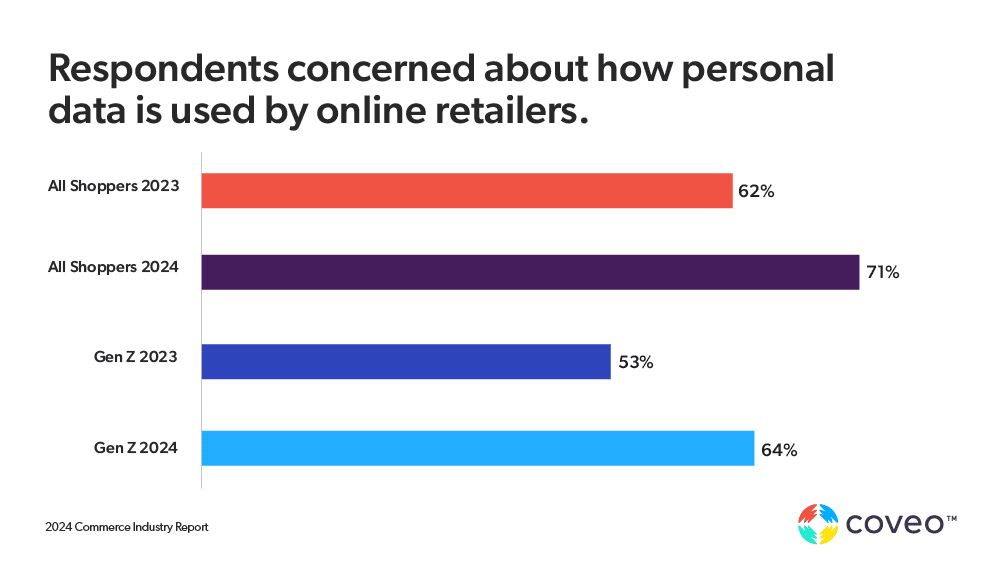

In 2024, consumers in general became more concerned about how online retailers use their personal information, rising from 62% in 2023 to 71% this year. Although digital native Gen Zs are less likely to be worried, their level of concern has also increased, from 53% in 2023 to 64% in 2024.

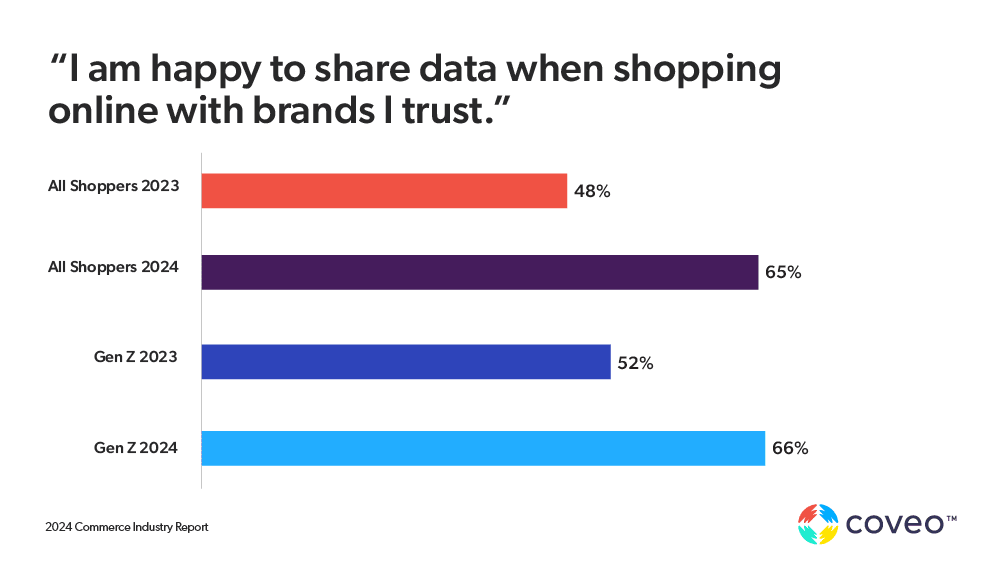

Paradoxically, consumers of all ages are more willing in 2024 to share personal data with brands they trust, rising from 48% to 65%. For Gen Zers, the percentage went from 52% to 66%.

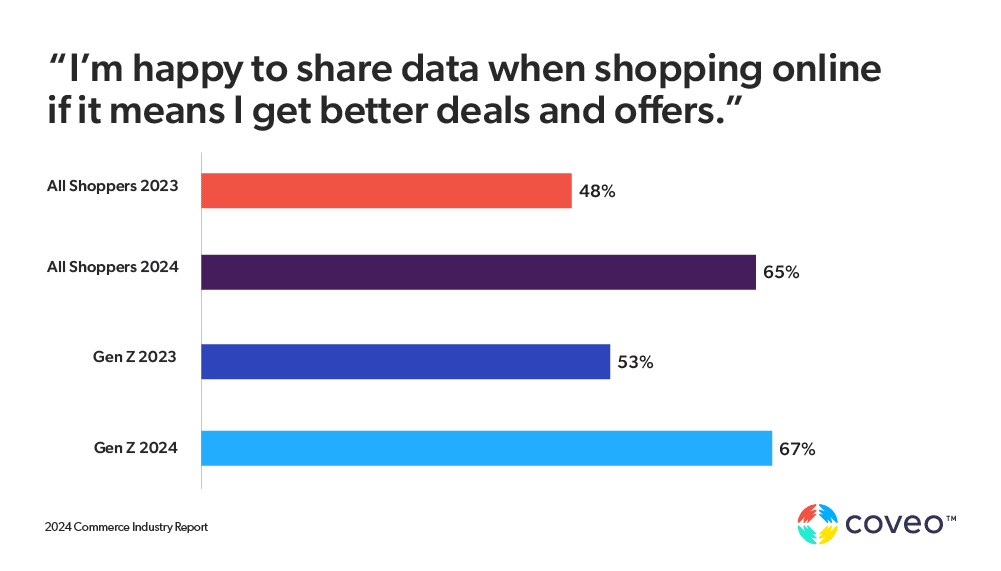

As a money-conscious generation, Gen Zers are more willing than shoppers overall to exchange personal information for better deals and offers, and the percentage of Gen Zers willing to share data for deals rose from 53% in 2023 to 67% in 2024. This year, the percentage of overall shoppers who are willing to make that bargain increased from 48% to 65%, possibly reflecting the effects of inflation.

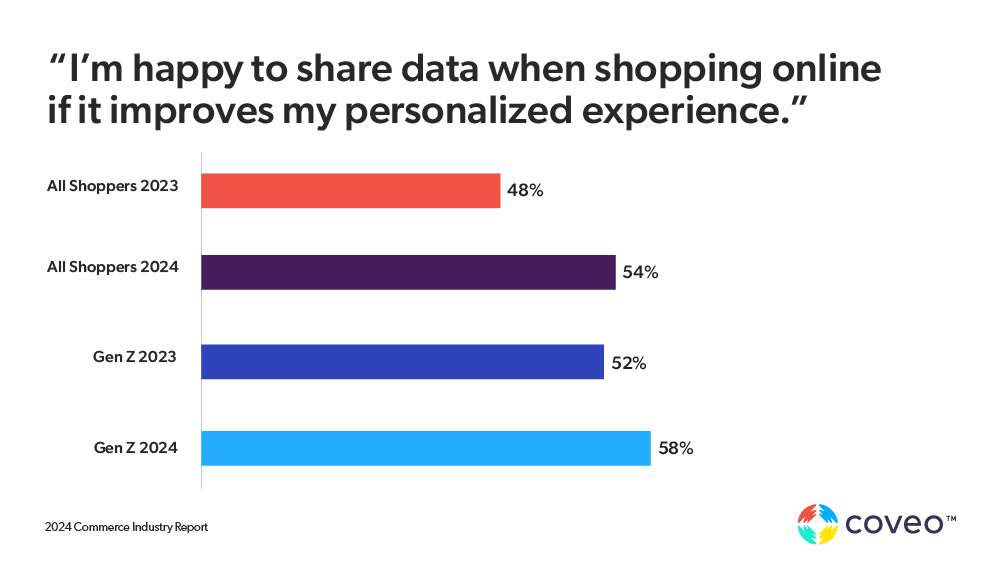

The share of shoppers who are happy to share data if it improves their personalized experience also spiked, going from 41% in 2023 to 54% in 2024. Gen Zers were more amenable to sharing data for personalization in 2023, at 52%, but that tendency increased in 2024 to 58%.

What these findings tell retail brands is this: Once you develop trust and loyalty with your customers, you have a big advantage over other retailers because you can collect customer data and use it to personalize deals and offers. If the personalized deals and offers score with customers, retailers gain more loyalty and trust and build durable lifetime customer value.

Capturing Gen Z Hearts and Dollars: Tips for Retailers

With 96% of Gen Zers reporting problems with their ecommerce experiences—a number that has stayed stubbornly high over years of Coveo surveys—retailers must make sure that their websites are fully functional in terms of speed and accuracy, that they deliver findability and recommendations that match Gen Zers’ standards, and that they experiment with GenAI to help improve customer experiences.

Members of Generation Z are careful about how they spend, even as their incomes and discretionary budgets increase in adulthood. Retailers will win with Gen Zers by offering high-quality goods at a great value.

Personalization is the key for positive brand perception, customer engagement, and customer loyalty across generations, not only with Gen Z. Shoppers are willing to share their personal data with trusted retailers in return for relevant recommendations and deals tailored to their preferences. Retailers must protect customer data to reap these benefits, but they need not be hesitant to provide personalization at every step of the customer journey.

Dig Deeper

Download Coveo’s latest commerce industry report, “With Overwhelming Choice, What Really Drives Shopper Decisions?” to understand the big picture of shopping trends for the coming year and beyond.