While the majority of the retail sector’s revenue—83% in the U.S. and 68% in the U.K.—still comes from physical stores, 94% of shoppers start or end their retail experiences online, according to the fourth annual Coveo Commerce Industry Report, “With Overwhelming Choice, What Really Drives Shopper Purchase Decisions?”

This ecommerce trend is gleaned from a survey of 2,000 U.S. and 2,000 U.K. adults conducted in partnership with Arlington Research, and it demonstrates conclusively that ecommerce sites and mobile apps have a much bigger impact on a retailer’s business than their share of market would indicate.

And the impact of disappointing customers online is similarly disproportionate because 91% of shoppers expect their online experiences to match or exceed their experiences in stores.

Ecommerce Trends and Buyer Habits Shift

Keeping up with ecommerce trends and the ever-changing buying habits of the shopper is crucial. The 2024 Coveo study brought to light several other ecommerce trends and shopper insights that retailers can use to strengthen their ecommerce efforts over the next 12 months:

- Online shoppers are looking to Generative Artificial Intelligence (GenAI) to improve their customer experience, with 72% expecting technologies like OpenAI’s ChatGPT or Coveo’s generative answering to change it for the better.

- Consumers are more concerned about customer data privacy online than they were a year ago, but they are also more willing to share data for better deals and offers.

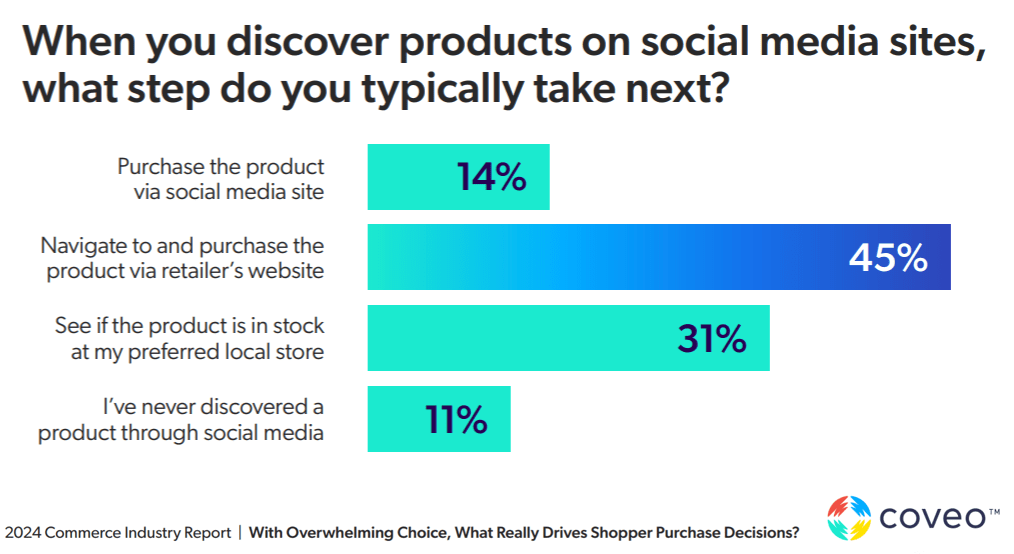

- Although platforms like Facebook and Instagram have invested in and promoted social commerce, only 14% of shoppers make final purchases via social channels.

- Despite their high expectations for ecommerce, 49% of online shoppers encounter problems of some sort, and 68% of shoppers report issues when they try to use online self-service to solve problems on their own.

- Looking at what happens after a transaction is made (post-purchase), where 49% of respondents experienced issues, the report calls it an opportunity for online retailers to turn the tables and improve customer loyalty.

- More than 60% of shoppers revealed two things ecommerce sites could do to have the greatest impact on their perception of a retail brand: 44% would be swayed by being able to find what they’re looking for in just a few clicks, and 18% agree that finding supporting content would influence them.

Let’s dig deeper into ecommerce trends.

Ecommerce Execution Clashes with Online Customer Experience

In each of the four years of the Coveo commerce study, 90% percent or more of the respondents have agreed that the online buying experience should be better than, or equal to, the traditional retail store experience.

They also keep saying that their experiences on retail shopping sites don’t meet those expectations.

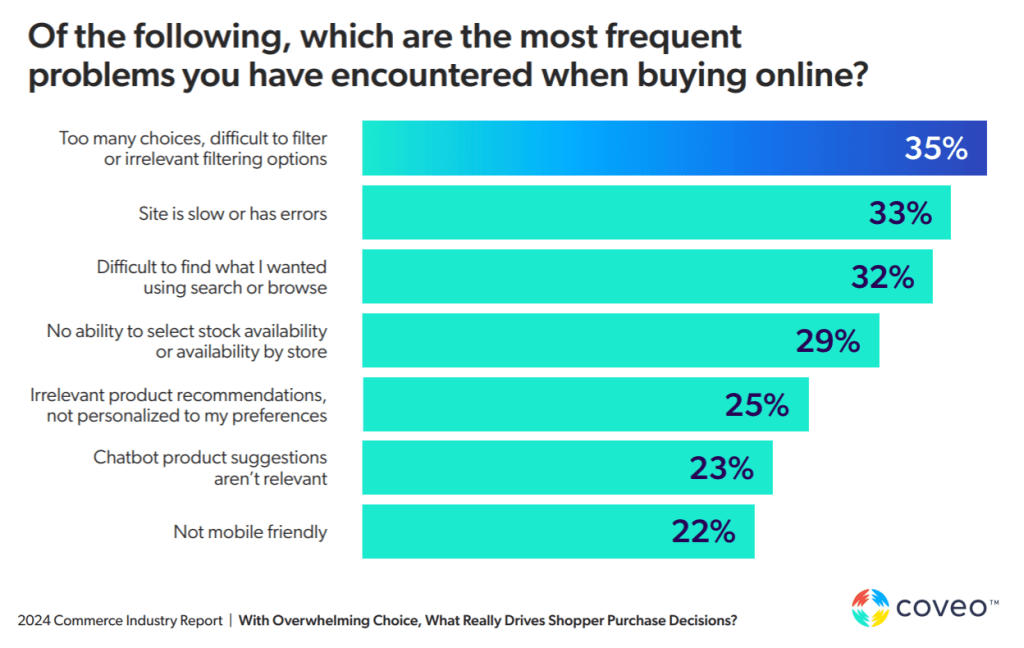

The top challenges shoppers face when buying online in 2024 include “too many choices/difficult to filter” (35%), “site is slow/has errors” (33%), “difficult to find what I wanted using search” (32%), and “irrelevant product recommendations/not personalized (25%).”

Online retailers don’t have the luxury of failing to execute on the basics. And the importance of retail websites and mobile apps can’t be emphasized enough, given how deeply they are threaded into almost every retail buying decision.

Shoppers frequently research products via search before buying with an online retailer (59%) and research products online before making a purchase in-store (47%). For example, when buying a large furniture item such as a couch, shoppers will likely want to see it in store to test, touch, and see its true size and color before completing a purchase online. Conversely, shoppers might search the website of their local DIY store for a specific part or tool they want, to ensure they have it in stock before going to the store to pick it up.

Shoppers also browse in stores before buying online (29%), peruse social media before buying in a physical store (23%), discover and buy products on social media platforms (19%), and look around stores before buying on social media (8%)

Retailers Compete to Offer Conversational Experiences

Retailers are considering or introducing GenAI solutions that answers to customer questions in a conversational way. According to a survey of 1,390 retailers worldwide by Salesforce and the Retail AI Council, 81% have a budget dedicated to AI, and about half of that amount is allocated to GenAI projects.

As Lisa Grayston, General Manager of Commerce at Coveo, observes, “With the advent of generative AI, online shopping can transcend mere transactions and become conversational and advisory. It’s crucial for retailers to adapt to this shift before they lose ground to their competitors.”

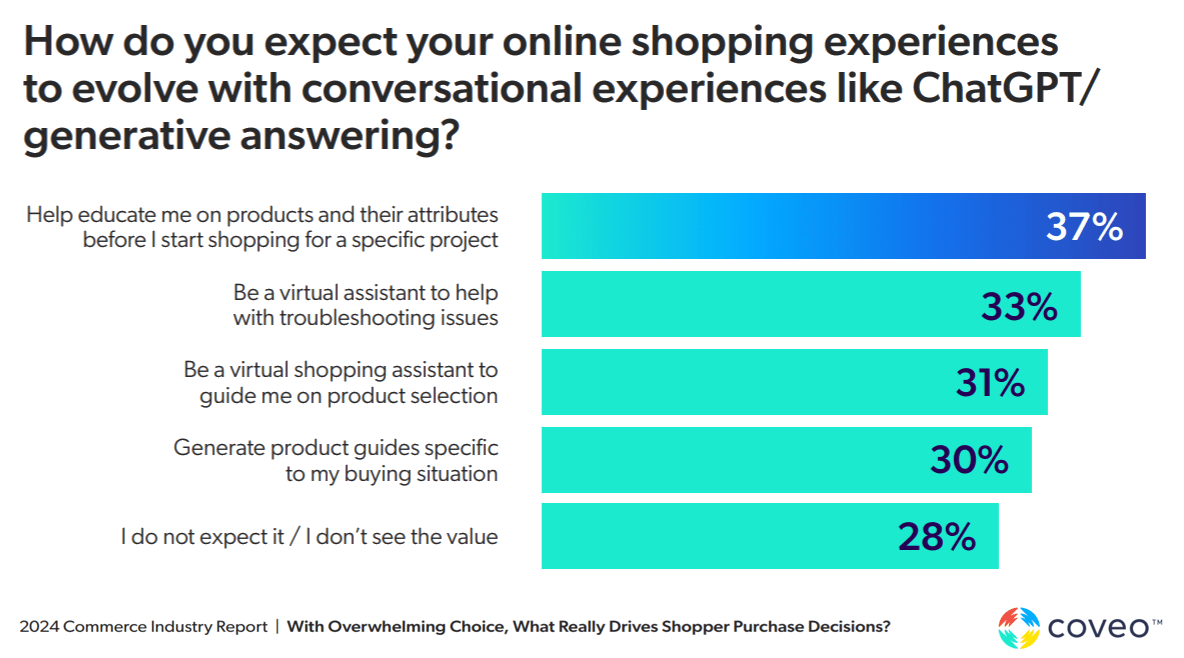

Coveo asked consumers how they expect online shopping to evolve with GenAI-powered conversational commerce.

Almost one in four (37%) thought it would help them become better educated on products and their attributes before they start shopping. Many gravitated toward the idea of virtual assistants, which could help with troubleshooting (33%) or guide product selection (31%). Thirty percent anticipated that GenAI could produce product guides customized to their specific buying situation.

While some whose understanding of GenAI is still at a nascent stage, have no expectations or are not seeing the value of GenAI yet.

The report suggests that retailers rethink product discovery by streamlining the customer’s path to purchase with AI: “Inject an intelligence layer to your site that provides them with personalized search suggestions, dynamic filters that adjust to each request, and generative AI that answers their questions like an in-store advisor would.”

Shoppers Use Social Media for Discovery, Not to Buy

When Meta (Facebook and Instagram) integrated shopping functionality into its popular apps, social commerce was supposed to take off, but it hasn’t affected the retail market much. While 39% of Coveo survey respondents “often” or “always” find products that catch their interest on social media—a figure that balloons to 55% for Gen Z—only 14% go on to purchase within the app.

Almost half (45%) navigate from social media to a retailer’s website to buy, and 31% look to see if their local store carries the item.

The bottom line: Social media sparks interest, but ecommerce and traditional retail converts.

The Final Takeaway

Customers demand seamless, personalized interactions, and if you’re not delivering, they’ll swiftly migrate to more accommodating online experiences. This means optimizing your digital ecosystem with search and product discovery powered by AI. Investment in search and product discovery is not only important to drive online conversions, but it also has a disproportionate effect on in-store revenue.

Successful retail brands understand that centering their efforts on the shopper, not the shopping channel, guarantees that they will meet customers wherever they are in their discovery journey—and capture the sale.

Uncover More Insights

Pick up additional insights for yourself by downloading your own copy of Coveo’s complete 2024 Commerce Industry Report.